Implementing an Enterprise Resource Planning (ERP) system is a significant undertaking for any organization, especially when it comes to accounting and financial management. An ERP system integrates various business processes and operations into one unified system, streamlining data and workflow. A successful ERP implementation can transform an accounting department, improving efficiency, accuracy, and strategic decision-making.

However, the process is complex and often challenging, requiring careful planning and execution. This article aims to be an comprehensive guide, drawing on decades of experience, to provide a clear roadmap for accounting professionals seeking to navigate this journey successfully.

This article will address common pain points, offer practical advice, and outline proven strategies to ensure a smooth and effective ERP implementation, tailored to the unique needs of accounting departments. By the end, readers should feel empowered, understanding the key steps, potential pitfalls, and benefits of this transformative process.

Read Also: Organizational change and organizational innovation

Table of Contents

Understanding the Need for ERP in Accounting

Accounting and financial management are the heart of any organization, and as such, they have unique requirements when it comes to ERP implementation. Financial data is sensitive, critical for compliance, and essential for strategic decision-making. An ERP system tailored to accounting needs can offer numerous benefits:

- Data Centralization and Accuracy: An ERP system unifies financial data from various sources, ensuring a single source of truth. This eliminates errors caused by manual data entry, inconsistent data formats, and incompatible systems.

- Streamlined Processes: By automating routine tasks and standardizing processes, an ERP system reduces the time and effort required for financial reporting, budgeting, and forecasting. This frees up resources for more value-added activities.

- Improved Compliance and Audit Trail: With all financial data in one system, compliance and audit trails become more manageable. ERP systems provide built-in controls and automated reporting, reducing the risk of errors and ensuring regulatory compliance.

- Enhanced Decision-Making: Real-time financial data and advanced analytics capabilities within an ERP system empower accounting professionals to provide more accurate and timely insights, supporting strategic decision-making across the organization.

- Better Collaboration: ERP systems facilitate collaboration by providing a shared platform for different teams and departments. This improves communication and enables a more holistic view of the organization’s financial health.

Key Considerations for a Successful Implementation

A successful ERP implementation requires careful planning and consideration of various factors. Understanding these key aspects will help ensure a smooth process and maximize the benefits realized.

- Define Clear Objectives: Start by defining specific and measurable goals for the implementation. Are you aiming to improve data accuracy, streamline reporting, or enhance decision-making? Clear objectives will guide the entire process and provide a framework for evaluating success.

- Assess Current Processes: Conduct a thorough review of existing accounting processes, identifying pain points and inefficiencies. This will help ensure that the new ERP system addresses these challenges effectively. Involve key stakeholders and subject matter experts to gather comprehensive insights.

- Choose the Right Solution: Select an ERP solution that is tailored to your industry and organization’s unique needs. Consider the functionality required, scalability, and compatibility with existing systems. Involve IT professionals in this process to ensure a technically feasible choice.

- Manage Data Migration Carefully: Data migration is often the most complex aspect of ERP implementation. Develop a comprehensive plan for migrating historical and current financial data to the new system, ensuring data integrity, security, and compliance.

- Focus on Change Management: ERP implementation brings significant changes to workflows and processes. Effective change management is crucial to ensuring user adoption. Provide comprehensive training and support to help users understand the new system and its benefits.

- Ensure Strong Project Management: Successful ERP implementation requires strong project management skills. Establish clear timelines, assign responsibilities, and set up regular progress reviews to keep the project on track.

- Select the Right Implementation Partner: Unless you have significant in-house expertise, choosing a reputable implementation partner is vital. Look for a partner with accounting-specific ERP experience and a proven track record of successful projects.

- Plan for the Long Term: ERP implementation is not a one-time project. It requires ongoing maintenance, updates, and support. Plan for the long-term success of the system by allocating appropriate resources and establishing a clear governance structure.

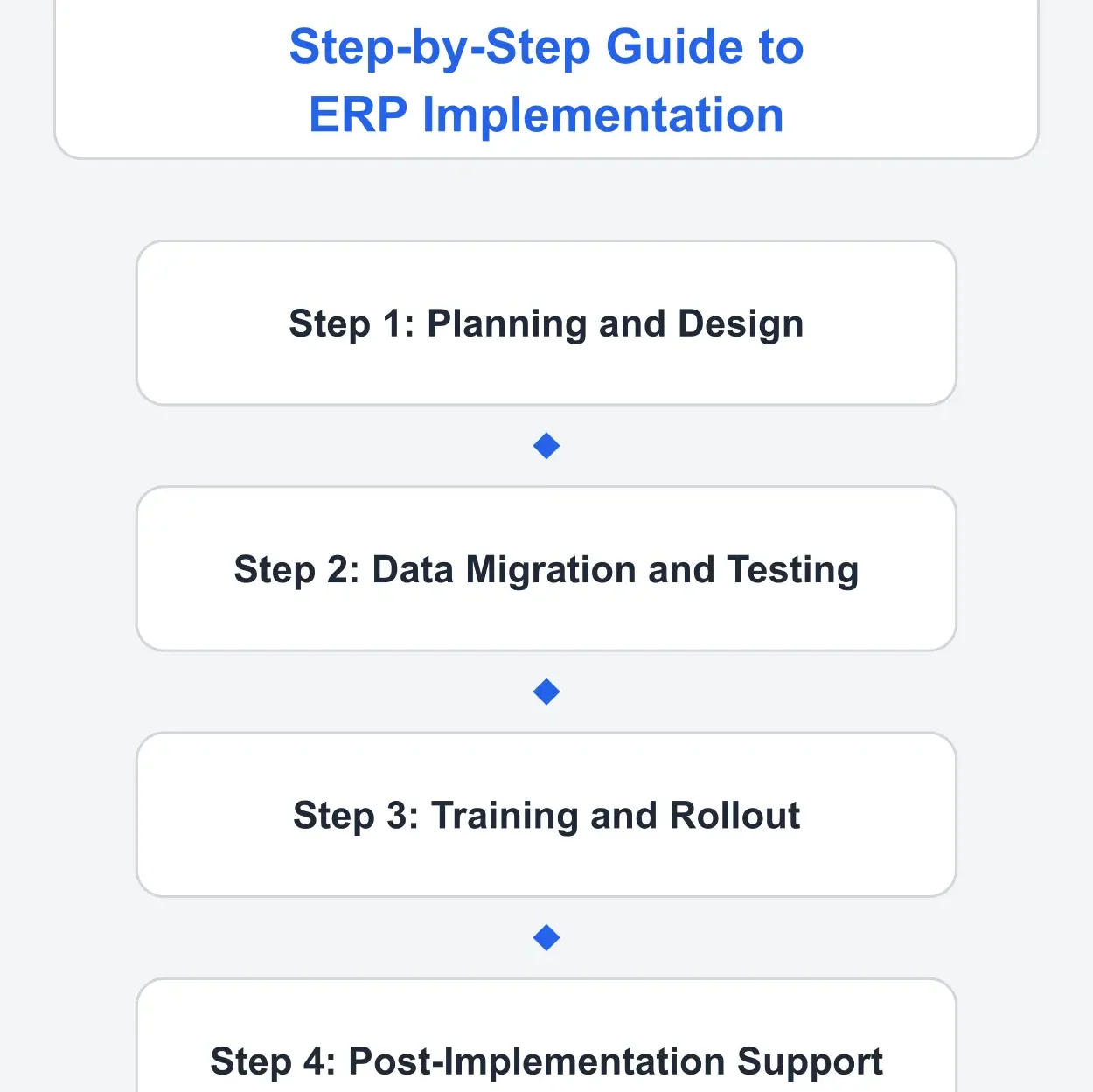

Step-by-Step Guide to Implement a Successful ERP System in Accounting

The following is a detailed, step-by-step guide to implementing your ERP system, ensuring a methodical and controlled process.

Read Also: Taylor and the Scientific Organization of Labor (OST)

1. Planning and Design

- Form a Project Team: Assemble a dedicated project team with clear roles and responsibilities. This team should include accounting professionals, IT experts, and representatives from other key departments.

- Define Scope and Objectives: Clearly define the scope of the project, including specific functionalities and processes to be included. Ensure these are aligned with your defined objectives.

- Choose the Right Solution: If you haven’t already, select your ERP solution based on your specific needs and budget. Consider the solution’s flexibility, scalability, and ability to integrate with existing systems.

- Develop a Detailed Plan: Create a comprehensive project plan with timelines, tasks, and dependencies. Identify potential risks and develop mitigation strategies. This plan should guide the entire implementation process.

- Design System Architecture: Work with IT experts to design the system architecture, ensuring it meets performance, security, and scalability requirements. Consider cloud or on-premise solutions, or a hybrid approach.

- Customize and Configure: Tailor the ERP solution to your specific needs, configuring the system to match your processes and requirements. This may involve developing custom modules or integrating third-party solutions.

2. Data Migration and Testing

- Prepare Data: Cleanse and validate historical and current financial data in preparation for migration. Ensure data integrity and consistency, resolving any data quality issues.

- Develop a Data Migration Plan: Create a detailed plan for migrating data to the new system, including timelines and responsibilities. Ensure data security and compliance throughout the process.

- Execute Data Migration: Carefully execute the data migration, testing and validating data at each stage. Use tools and methodologies provided by your ERP vendor to ensure a smooth and secure migration.

- System Testing: Conduct comprehensive system testing, including unit, integration, and user acceptance testing (UAT). Identify and address any issues or bugs, ensuring the system meets requirements and user expectations.

- Performance Testing: Assess system performance to ensure it meets expected standards. Identify any bottlenecks and optimize the system for speed and efficiency. Consider load testing to simulate real-world usage.

3. Training and Rollout

- Develop a Training Plan: Create a training curriculum tailored to different user roles and needs. Offer a blend of online and in-person training sessions to ensure comprehensive understanding.

- Provide Comprehensive Support: Assign dedicated support personnel to assist users during and after the rollout. Ensure quick response times and easy accessibility to build user confidence.

- Communicate Changes: Keep all stakeholders informed about the upcoming changes, benefits, and potential impacts. Regular communication helps manage expectations and ensures user buy-in.

- Phased Rollout: Consider a phased rollout, starting with a pilot group and gradually expanding to other departments or locations. This approach helps manage risks and allows for course correction if needed.

- Gather User Feedback: Encourage users to provide feedback on the new system, and address any concerns promptly. User feedback is vital for refining processes and ensuring a positive user experience.

4. Post-Implementation Support and Optimization

- Ongoing Support: Provide ongoing support and maintenance to address user queries and system issues. Regularly review system performance and user satisfaction, making improvements as needed.

- Monitor System Performance: Continuously monitor system performance, identifying areas for optimization. Use analytics and reporting tools to gain insights and make data-driven decisions.

- Regular Updates and Upgrades: Stay current with vendor updates and upgrades to access new features and ensure security. Develop a plan for managing these updates with minimal disruption to users.

- Process Refinement: Regularly review and refine processes, identifying opportunities for further efficiency gains. Leverage the ERP system’s capabilities to streamline additional areas of your accounting processes.

- Expand Functionality: As users become comfortable with the system, consider expanding its functionality to other areas of the business. This could include integrating additional modules or extending the system to other departments.

Benefits and Impact

A successful ERP implementation in accounting brings numerous benefits that impact not just the finance department but the entire organization.

- Improved Data Accuracy: With a unified ERP system, financial data is consistent and accurate, eliminating errors caused by manual processes and data silos. This improves the reliability of financial reporting and decision-making.

- Streamlined Processes: Standardized and automated processes save time and effort, reducing the administrative burden on accounting professionals. This enables them to focus on value-added activities, such as financial analysis and strategic planning.

- Enhanced Compliance: ERP systems provide built-in controls and automated compliance reporting, reducing the risk of errors and ensuring regulatory compliance. This helps organizations avoid fines and reputational damage.

- Better Decision-Making: Real-time financial data and advanced analytics capabilities enable accounting professionals to provide timely and accurate insights. This empowers leaders to make more informed strategic decisions.

- Improved Collaboration: A shared platform for different teams and departments enhances collaboration and communication. This breaks down silos and fosters a more holistic view of the organization’s financial health.

- Cost Savings: By streamlining processes and improving efficiency, ERP systems can lead to significant cost savings. Reduced manual effort and improved data accuracy contribute to lower operational costs.

- Scalability and Growth: ERP systems provide a solid foundation for organizations to scale and grow. They enable efficient management of increased transaction volumes, multiple entities, and complex financial structures.

Common Pitfalls and How to Avoid Them

While a successful ERP implementation can bring significant benefits, the process is not without potential pitfalls. Being aware of these common challenges will help you navigate them effectively.

- Lack of Planning: Insufficient planning is a major cause of ERP implementation failures. Avoid this by allocating adequate time and resources to the planning phase. Develop a detailed project plan, considering all aspects, including data migration, testing, training, and change management.

- Underestimating Data Migration: Data migration is often more complex and time-consuming than anticipated. To avoid this pitfall, start the data migration process early, thoroughly assess and cleanse your data, and develop a comprehensive migration plan. Ensure data security and compliance throughout.

- Resistance to Change: User resistance is a common challenge. Address this by involving users early in the process, communicating the benefits, and providing comprehensive training and support. Ensure users understand the impact of the new system on their daily tasks and highlight how it will make their lives easier.

- Insufficient Testing: Inadequate testing can lead to system issues and user dissatisfaction. Avoid this by conducting thorough system, integration, and UAT testing. Identify and address any bugs or performance issues before the rollout.

- Poor Change Management: ERP implementation brings significant changes to processes and workflows. Poor change management can hinder user adoption. Ensure effective change management by providing clear and frequent communication, addressing concerns, and offering support throughout the transition.

- Unrealistic Expectations: Setting unrealistic expectations can lead to disappointment and resistance. Manage expectations by clearly communicating the scope, timelines, and potential disruptions during the implementation process. Highlight both the benefits and challenges.

- Lack of Post-Implementation Support: Many organizations fail to plan for the long-term success of the ERP system. Ensure ongoing support and maintenance by allocating appropriate resources and establishing a clear governance structure.

Wrapping Up

Implementing an ERP system in accounting is a complex but highly rewarding endeavor. By following the comprehensive guide outlined in this article, accounting professionals can navigate the process successfully, avoiding common pitfalls and maximizing the benefits realized.

Read Also: Servant Leadership Description

A well-planned and executed ERP implementation transforms financial management, improving data accuracy, streamlining processes, and enhancing decision-making. It empowers accounting teams to contribute more strategically to the organization’s success while ensuring compliance and reducing costs.

Remember, each organization is unique, and your ERP implementation should be tailored to your specific needs. Draw on the expertise of experienced professionals, learn from their successes and failures, and adapt their advice to your context. With careful planning, a measured approach, and a focus on user needs, you can achieve a successful ERP implementation, driving your accounting department forward into the future.

Read Also: Strategies and Structures in the Company – What Relations?